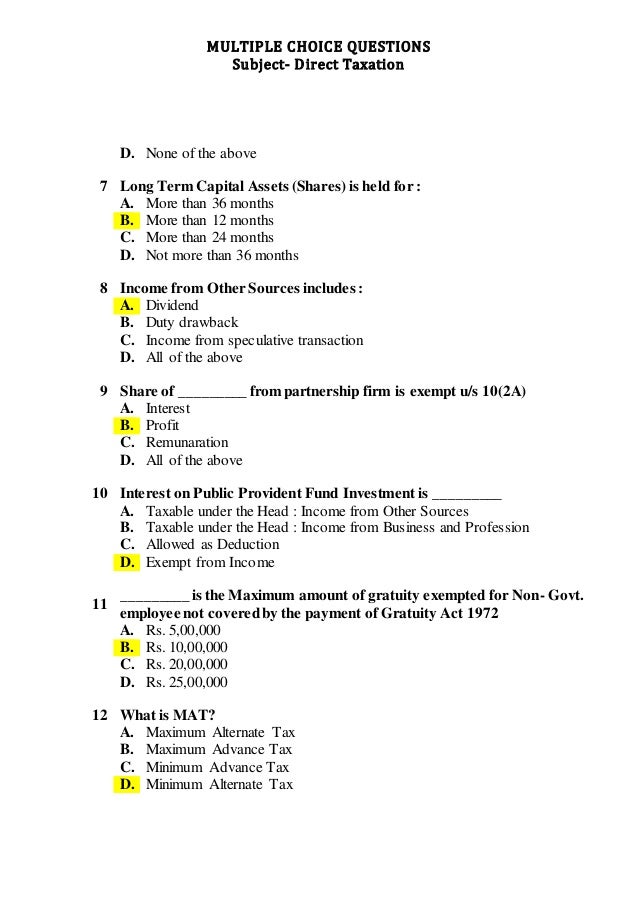

In the case of a non corporate taxpayer to whom the provisions of alternate minimum tax amt applies tax payable cannot be less than 18 5 hec of adjusted total income computed as per section 115jc.

Minimum alternate tax mat pdf.

Minimum alternate tax mat.

Minimum alternate tax mat markets and mayhem.

Over the last year foreign portfolio investors fpis have been asked to pay mat on the past capital gains.

The manner of computation of mat has been prescribed in section 115jb.

Year it is a new tax controversy.

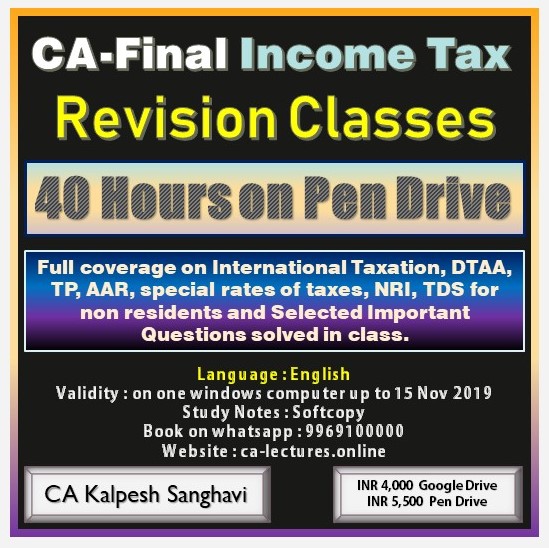

For provisions relating to amt refer tutorial on mat amt in tutorial section.

In india mat is levied under section 115jb of the income tax act 1961.

15th june 2017 1.

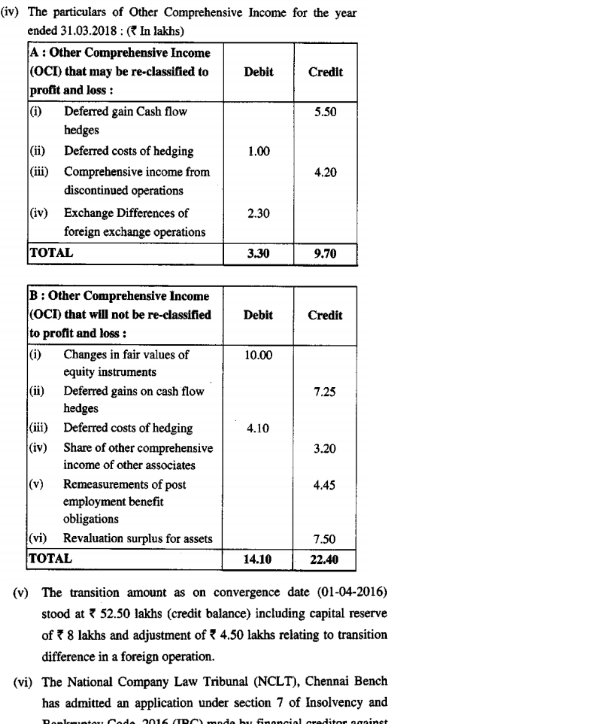

Introduction as the book profit based on ind as compliant financial statement is likely to be different from the book profit based on existing indian gaap the cbdt constituted a committee in june 2015 for suggesting.

In this part you can gain knowledge about various provisions relating to mat and amt.

It was introduced in the year 1987 and.

For fy 2019 20 tax payable is computed at 15 previously 18 5 on book profit plus applicable cess and surcharge.

Initially the concept of mat was introduced for companies and progressively it has been made applicable to all other taxpayers in the form of amt.

Mat is levied at the lower rate of 9 plus surcharge and cess as applicable for companies that are a unit of an international financial services centre and derive their income solely in.

Faced with requests for clarity the mat provisions were amended in 2015 to exempt fpis from paying mat on capital gains.

With mat companies have to pay up a minimum amount of tax to the government.

This tax is computed using a separate charging section altogether.